The Sensex share price target is a key topic for investors, particularly due to its significant role in reflecting the health of the Indian economy and overall stock market performance. As of November 27, 2024, the Sensex stands at 80,248.08 points, providing an interesting entry point for those looking to invest in the Indian market and consider long-term prospects.

Predicting future stock market index levels, especially for long-term horizons like 2030, 2040, and 2050, is speculative. However, we can make reasonable projections based on current market trends, macroeconomic conditions, and investor sentiment.

This article will discuss potential Sensex share price targets for the coming years, including both short-term and long-term predictions, while highlighting the factors that will drive Sensex’s performance.

You May Like: Gold Rock Investments Ltd Share Price Target 2024 to 2050

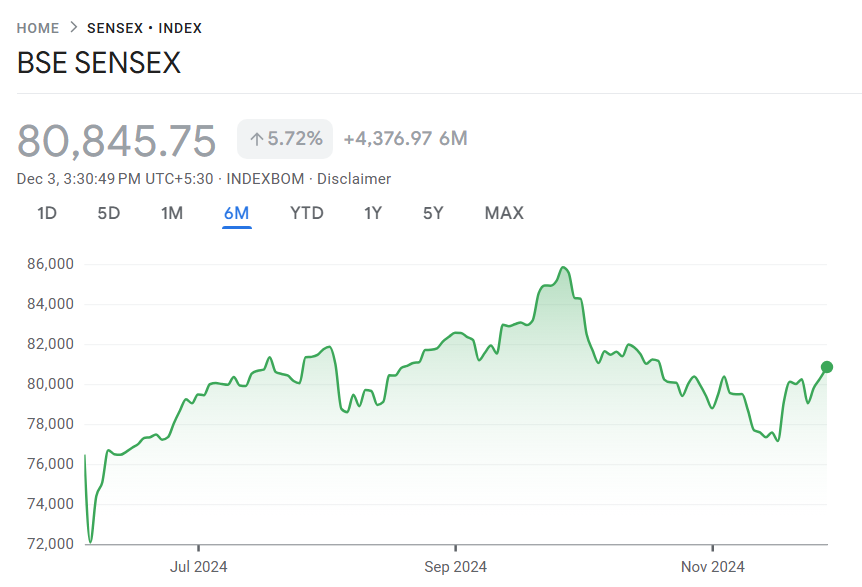

Current Sensex Share Price

As of November 27, 2024, the current Sensex share price stands at 80,248.08 points. The Sensex, being a key benchmark for India’s stock market, reflects the overall economic health and investor sentiment.

Comprising 30 of the largest and most financially sound companies listed on the Bombay Stock Exchange (BSE), the Sensex offers a broad overview of India’s economic performance.

At its current level of 80,248.08, the Sensex reflects the resilience of the Indian market, driven by its diversified sectors like banking, technology, energy, and manufacturing. The index is a key indicator for investors seeking insights into the broader market trends.

🔴 Live

Sensex Share Price Target 2024

For 2024, analysts predict that the Sensex share price target could range between 90,000 and 1,00,000 points. The primary drivers behind this projection include:

- Economic Growth: India’s strong GDP growth, a vibrant services sector, and increasing consumer demand are expected to support Sensex growth.

- Corporate Earnings: With consistent earnings from key sectors like IT, banking, and consumer goods, the Sensex is likely to see upward momentum.

- Global Economic Environment: Stability in global markets, particularly in key economies like the U.S. and Europe, will have a positive impact on Indian equities.

This forecast reflects a mix of solid domestic performance and favorable global conditions, which are expected to continue propelling the Sensex higher throughout 2024.

| Year | Sensex Share Price Target (Points) | Key Drivers |

|---|---|---|

| 2024 | 90,000 – 1,00,000 | Economic growth, Corporate earnings, Global economic stability |

Sensex Share Price Target 2025

Looking ahead to 2025, the Sensex share price target could potentially rise to 1,05,000 to 1,10,000 points. The reasons behind this optimistic projection include:

- Continued Economic Expansion: India’s economy is likely to continue growing, driven by a booming middle class, increased digital adoption, and infrastructure development.

- Foreign Investments: Increased foreign direct investment (FDI) into the country, especially in sectors like technology and manufacturing, will fuel further growth in the Sensex.

- Positive Corporate Earnings: As companies adapt to new markets and technologies, earnings growth in sectors like IT and pharmaceuticals will likely benefit the Sensex.

If these trends continue, Sensex could see significant gains, reinforcing investor confidence and positioning it as one of the leading stock market indices in the world.

| Year | Sensex Share Price Target (Points) | Key Drivers |

|---|---|---|

| 2025 | 1,05,000 – 1,10,000 | Economic growth, Foreign investments, Positive earnings growth |

Sensex Share Price Target 2030

By 2030, the Sensex share price could potentially reach 1,50,000 to 1,70,000 points, driven by several key factors:

- Economic Superpower Status: India is on track to become one of the world’s largest economies by 2030, which will naturally result in increased corporate profits and investments.

- Digital Transformation: India’s push towards becoming a digital economy will open up new growth avenues for companies, particularly in sectors like e-commerce, IT, and fintech.

- Infrastructure and Urbanization: The country’s focus on large-scale infrastructure projects, smart cities, and renewable energy will be major drivers of growth, further strengthening the Sensex.

With these developments, Sensex could potentially experience robust growth over the next decade, positioning India as a global economic leader.

| Year | Sensex Share Price Target (Points) | Key Drivers |

|---|---|---|

| 2030 | 1,50,000 – 1,70,000 | Economic superpower status, Digital transformation, Infrastructure and urbanization |

Sensex Share Price Target 2040

Looking further ahead, by 2040, the Sensex could potentially rise to 2,50,000 to 3,00,000 points. This long-term projection is based on several key factors:

- Technological Advancements: India’s leadership in emerging technologies such as artificial intelligence, renewable energy, and blockchain will provide new growth avenues for companies, boosting the Sensex.

- Global Influence: As India’s influence grows on the global stage, there will likely be a significant inflow of foreign investments, further supporting the growth of the Sensex.

- Expanding Consumer Market: India’s growing middle class, with increasing disposable income and consumption, will drive domestic demand and enhance the profitability of companies within the Sensex.

If these trends continue, the Sensex could be on track to experience major growth, both in the Indian and global contexts.

| Year | Sensex Share Price Target (Points) | Key Drivers |

|---|---|---|

| 2040 | 2,50,000 – 3,00,000 | Technological advancements, Global influence, Expanding consumer market |

Sensex Share Price Target 2050

Looking ahead to 2050, the Sensex share price target could potentially reach 4,00,000 to 5,00,000 points, assuming India remains a global economic powerhouse. Several factors will contribute to this long-term growth:

- India as a Global Economic Leader: By 2050, India is likely to be one of the top global economies, with its industries, consumer base, and technological leadership pushing the Sensex to new heights.

- Sustainability and Green Economy: India’s transition to sustainable energy, adoption of green technologies, and advancements in areas like space exploration will provide long-term growth drivers for Sensex companies.

- Global Investment Hub: India will likely be an attractive investment destination due to its demographic advantage, rapid urbanization, and technological advancements, further increasing Sensex valuations.

By 2050, Sensex could emerge as a global leader in stock market indices, reflecting India’s rise as a major economic and financial hub.

| Year | Sensex Share Price Target (Points) | Key Drivers |

|---|---|---|

| 2050 | 4,00,000 – 5,00,000 | India as global leader, Green economy, Global investment hub |

Key Factors Influencing the Sensex Share Price

Several key factors will influence the Sensex share price in the future:

- Economic Growth: India’s overall economic performance, including GDP growth, industrial output, and consumer spending, directly affects the performance of the Sensex.

- Corporate Earnings: The financial health of companies listed in the Sensex plays a crucial role in driving the index’s performance. Strong earnings growth in major sectors will support higher stock valuations.

- Government Policies: Regulatory frameworks, tax policies, foreign investment rules, and initiatives like “Make in India” and “Digital India” can either boost or hinder stock market growth.

- Global Market Trends: As an emerging market, India is highly influenced by global stock market trends and economic conditions. A downturn in global markets can negatively impact the Sensex, while global booms can boost it.

- Investor Sentiment: Market sentiment, including both domestic and international investors’ confidence, plays a pivotal role in driving stock market performance. Positive sentiment usually propels the Sensex higher.

FAQs About Sensex Share Price

1. What is the current share price of the Sensex?

As of November 27, 2024, the current Sensex share price is 80,248.08 points.

2. What is the Sensex share price target for 2024?

For 2024, the Sensex share price target is expected to range between 90,000 and 1,00,000 points.

3. What is the Sensex share price target for 2030?

By 2030, the Sensex could potentially reach 1,50,000 to 1,70,000 points, driven by strong economic growth and digital expansion.

4. What are the factors that will influence the Sensex share price?

Key factors include economic growth, corporate earnings, global market conditions, government policies, and investor sentiment.

5. What is the expected Sensex share price for 2050?

By 2050, the Sensex share price target could range from 4,00,000 to 5,00,000 points, assuming India maintains its position as a global economic leader.

You May Like: Mayukh Dealtrade Ltd Share Price Target 2024 to 2050

Conclusion

While predicting the exact Sensex share price target for the future is speculative, the growth potential of the index in the long term remains strong. India’s continued economic expansion, technological advancements, and a favorable investment climate will play a key role in driving the Sensex higher. As the Indian market matures and India becomes a global economic powerhouse, the Sensex share price could reach new heights, offering significant opportunities for investors.