The Blackbuck share price target has garnered attention from investors as the company, previously known as Zinka Logistics, continues to position itself as a leader in India’s growing logistics sector. With its recent IPO and strong market presence, Blackbuck is poised for growth in both the short and long term. This article explores the Blackbuck share price target forecast for 2024, 2025, 2030, 2040, and 2050, based on current market trends, key factors influencing the company’s performance, and long-term projections.

You May Like: Trojan Solar Share Price Target From 2024, 2030, 2035, 2040, 2050

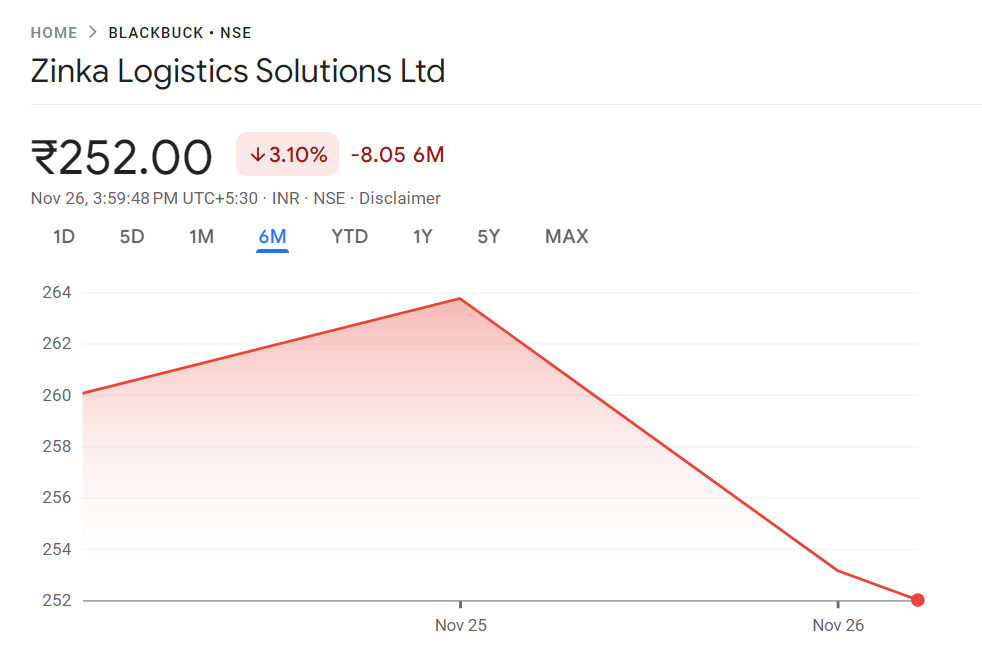

Current Share Price

As of November 26, 2024, the current share price of Blackbuck (Zinka Logistics) is ₹252. This price reflects the company’s market positioning after its IPO and the strong growth potential in the logistics industry.

Blackbuck Share Price Target 2024

The Blackbuck share price target for 2024 is expected to range between ₹275 and ₹300. This short-term growth is driven by the company’s recent IPO, market sentiment, and continued demand for logistics services in India.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2024 | ₹275 – ₹300 | Positive market sentiment following the IPO, continued demand for logistics services, and strong growth in India’s logistics sector |

Blackbuck’s strong financial backing from its IPO and strategic position in the logistics sector should support its growth in the coming months.

Blackbuck Share Price Target 2025

By 2025, the Blackbuck share price target is expected to range between ₹300 and ₹350. As the logistics industry in India continues to grow and Blackbuck expands its services, the company’s share price is likely to see significant appreciation.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹300 – ₹350 | Increased demand for logistics solutions, market expansion, and improved technological capabilities |

With the growing digitalization in the logistics sector and Blackbuck’s efforts to enhance its operational efficiency, the share price is projected to appreciate further.

Blackbuck Share Price Target 2030

Looking ahead to 2030, the Blackbuck share price target could range between ₹500 and ₹700, assuming the company continues to capitalize on growth opportunities in the logistics sector and expand its market share.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | ₹500 – ₹700 | Leadership in India’s logistics sector, further technological innovations, and continued growth in e-commerce and supply chain solutions |

The increasing demand for efficient logistics, especially with the rise of e-commerce, will be a significant growth driver for Blackbuck, contributing to substantial share price growth.

Blackbuck Share Price Target 2040

By 2040, the Blackbuck share price target could see substantial growth, potentially reaching ₹1,200 to ₹1,500, assuming the company maintains its leadership in the logistics sector and continues to innovate with new technologies.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | ₹1,200 – ₹1,500 | Dominance in the logistics and supply chain sector, global market expansion, and technological leadership |

Projections for 2040 will depend on the company’s ability to maintain a competitive edge and its ability to scale operations internationally.

Blackbuck Share Price Target 2050

For 2050, the Blackbuck share price target is highly speculative but could range between ₹2,500 and ₹3,000, driven by its potential to become a global leader in logistics and transportation solutions.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | ₹2,500 – ₹3,000 | Global expansion, technological advancements in logistics, and increased adoption of smart supply chain solutions |

This ambitious target reflects Blackbuck’s potential for long-term dominance in the global logistics sector, capitalizing on advancements in AI, automation, and global supply chains.

Key Factors Influencing Blackbuck’s Share Price

Several critical factors influence the Blackbuck share price:

- Logistics Industry Growth: As the logistics industry in India continues to expand, the demand for efficient logistics and supply chain solutions will drive Blackbuck’s revenue and growth.

- Technological Innovation: Blackbuck’s ability to innovate, including the use of AI, data analytics, and digital platforms, will play a crucial role in improving efficiency and reducing operational costs.

- Financial Performance: Consistent profitability, strong revenue growth, and operational efficiencies are essential to supporting long-term growth and increasing the share price.

- Competitive Landscape: Competition from other logistics companies, especially digital-first players, can affect market share and pricing strategies.

- Economic Conditions: Economic factors, including GDP growth, inflation, and interest rates, can influence the demand for logistics services and investor sentiment in the sector.

FAQs About Blackbuck Share Price Target

- What is the current share price of Blackbuck?

As of November 26, 2024, the current share price of Blackbuck is ₹252. - What is the Blackbuck share price target for 2024?

The share price target for 2024 is expected to range between ₹275 and ₹300. - What is the projected share price for 2030?

The share price target for 2030 is estimated to range between ₹500 and ₹700. - What factors influence Blackbuck’s share price?

Key factors include logistics industry growth, technological innovation, financial performance, and the competitive landscape. - Is Blackbuck a good long-term investment?

Yes, given its strong position in the growing logistics sector and its focus on innovation, Blackbuck is a solid long-term investment option. - What is the share price target for 2050?

The share price target for 2050 is estimated to range between ₹2,500 and ₹3,000.

You May Like: Multibase India Ltd Share Price Target From 2024 to 2030

Conclusion

The Blackbuck share price target forecast for 2024, 2025, 2030, 2040, and 2050 highlights the company’s growth potential, driven by its leadership in the logistics sector, technological innovation, and the increasing demand for efficient supply chain solutions. As Blackbuck Ltd. continues to expand its market share, improve operational efficiency, and innovate in logistics technology, it is well-positioned for both short-term and long-term growth. For investors looking to capitalize on the logistics sector’s growth, monitoring the Blackbuck share price offers valuable insights into future opportunities.