Dixon Technologies (India) Ltd. is a leader in the electronics manufacturing services (EMS) sector, offering a wide range of products including LED TVs, mobile phones, and home appliances. As of December 2, 2024, the current price of Dixon Technologies is ₹16,770.00, and investors are closely watching its performance, especially with the company’s increasing market share and growth potential.

Predicting long-term stock prices is speculative, and many factors influence the performance of stocks, including economic conditions, industry trends, and company performance. However, based on the current market environment, analyst projections, and Dixon Technologies’ growth trajectory, here are the potential estimates for the Dixon Technologies share price in the future.

You May Like: MMTC Share Price Target 2024, 2025, 2030, 2040, 2050

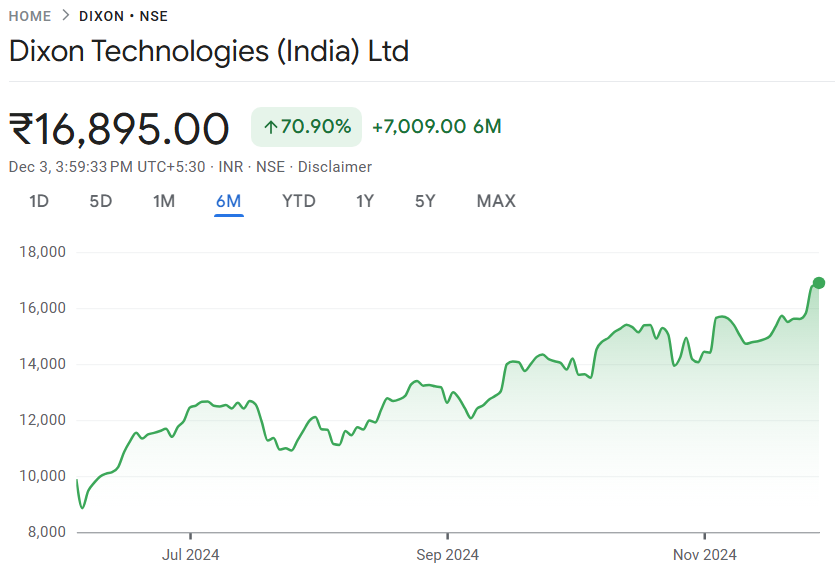

Current Dixon Technologies Share Price

As of December 2, 2024, the Dixon Technologies share price is ₹16,770.00. Dixon Technologies has earned a strong reputation in the Indian electronics manufacturing market due to its high-quality products, strategic partnerships, and focus on innovation. Its focus on providing end-to-end solutions in the electronics space has enabled it to grow rapidly, making it a promising stock for investors.

Given the company’s consistent performance and positive growth outlook, Dixon Technologies’ share price is expected to see significant movement in the coming years. Let’s dive into potential share price targets for Dixon Technologies for the short, medium, and long term.

🔴 Live

Dixon Technologies Share Price Target for 2025

Looking at 2025, analysts predict that Dixon Technologies’ share price could reach ₹20,000 to ₹22,000. This estimate is based on several key factors:

- Strong Market Position: Dixon Technologies has a solid presence in the Indian market and a growing share in the global electronics manufacturing sector. As the demand for consumer electronics and appliances rises, Dixon is likely to benefit from its diversified portfolio.

- Government Support: The Indian government’s push to promote domestic manufacturing, especially in the electronics sector, is likely to benefit companies like Dixon Technologies. Various incentives under the PLI (Production-Linked Incentive) scheme could help boost growth.

- Innovation and Expansion: Dixon is continually innovating its products and expanding its portfolio, particularly in high-growth sectors such as smartphones, LED TVs, and home appliances. This should help it achieve higher revenue and profitability.

In 2025, Dixon Technologies is expected to see a solid price increase, reaching a target range of ₹20,000 to ₹22,000.

| Year | Dixon Technologies Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹20,000 – ₹22,000 | Market position, Government support, Product innovation |

Dixon Technologies Share Price Target for 2030

By 2030, Dixon Technologies’ share price could potentially rise to ₹30,000 to ₹40,000, assuming continued growth in both domestic and international markets. Here’s why this growth target is achievable:

- Increasing Market Share: As Dixon Technologies continues to expand its product portfolio and enter new markets, both within India and globally, it is likely to see significant revenue growth. The company is already a key player in several high-demand sectors, and its market leadership will help sustain long-term growth.

- Strong Financial Performance: Dixon Technologies has shown impressive revenue growth and profitability, which is likely to continue as the company benefits from economies of scale, efficient operations, and increased demand for electronics.

- Technological Advancements: The company’s ability to adapt to and lead in the rapidly evolving electronics industry will be a key driver of its success. The rise of next-generation technologies, such as 5G, AI-enabled devices, and smart homes, could provide Dixon with new revenue opportunities.

By 2030, Dixon Technologies is well-positioned to reach a share price of ₹30,000 to ₹40,000, driven by its strong growth trajectory and expanding market presence.

| Year | Dixon Technologies Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | ₹30,000 – ₹40,000 | Market expansion, Financial performance, Technological advancements |

Dixon Technologies Share Price Target for 2040

Looking ahead to 2040, Dixon Technologies’ share price could potentially rise to ₹60,000 to ₹80,000, assuming the company continues to lead in product innovation, market expansion, and operational excellence. Key growth drivers include:

- Global Expansion: As Dixon Technologies expands its footprint in international markets, particularly in the Americas, Europe, and Asia, it will benefit from the growing demand for consumer electronics globally.

- Sustainability and Innovation: The company’s commitment to sustainability and innovation will keep it competitive in the ever-evolving electronics sector. Leveraging advanced technologies like IoT (Internet of Things), AI (Artificial Intelligence), and smart electronics could provide Dixon with higher margins and new growth avenues.

- Rising Demand for Electronics: With global demand for consumer electronics expected to continue rising, Dixon Technologies stands to gain significantly from both the domestic and international markets.

If Dixon Technologies maintains its market leadership and continues to grow both in revenue and profitability, its share price could increase to ₹60,000 to ₹80,000 by 2040.

| Year | Dixon Technologies Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | ₹60,000 – ₹80,000 | Global expansion, Innovation, Rising demand for electronics |

Dixon Technologies Share Price Target for 2050

Looking at 2050, predicting the exact Dixon Technologies share price is challenging. However, if the company continues to innovate and maintain its market leadership, it could see significant growth, potentially reaching ₹1,00,000 to ₹1,50,000. Some key factors include:

- Continued Innovation: As a leader in the electronics manufacturing space, Dixon’s ability to drive technological innovation will be critical in maintaining a competitive edge.

- Smart Home and IoT Growth: As smart homes and IoT-enabled devices become increasingly ubiquitous, Dixon Technologies could experience rapid growth in its high-margin electronics segments.

- Sustainability: Companies that focus on sustainability and green manufacturing processes are likely to perform well in the long term. Dixon’s ability to adapt to these trends could help it maintain strong growth.

While it’s speculative to predict Dixon Technologies share price for 2050, if the company continues on its growth trajectory, it could potentially reach ₹1,00,000 to ₹1,50,000 by 2050.

| Year | Dixon Technologies Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | ₹1,00,000 – ₹1,50,000 | Technological leadership, Smart home growth, Sustainability initiatives |

Key Factors Influencing Dixon Technologies’ Share Price

Several key factors will influence the future Dixon Technologies share price:

- Company Performance: Strong financial performance, including revenue growth and profitability, will be crucial to maintaining investor confidence and driving share price appreciation.

- Industry Trends: The electronics manufacturing industry is evolving rapidly, with emerging trends such as 5G, IoT, and AI driving demand for new products. Dixon Technologies’ ability to innovate and capitalize on these trends will be key.

- Government Support: The Indian government’s policies to support domestic manufacturing, including incentives for electronics manufacturers, could have a positive impact on Dixon Technologies’ growth.

- Economic Conditions: Broader economic factors, such as GDP growth, inflation, and consumer spending, will impact demand for consumer electronics, which in turn affects Dixon’s business performance.

FAQs About Dixon Technologies Share Price

1. What is the current share price of Dixon Technologies?

As of December 2, 2024, Dixon Technologies’ current share price is ₹16,770.00.

2. What is the Dixon Technologies share price target for 2025?

In 2025, Dixon Technologies could reach a target price range of ₹20,000 to ₹22,000, driven by market position and product innovation.

3. What is the Dixon Technologies share price target for 2030?

By 2030, Dixon Technologies could see its share price reach ₹30,000 to ₹40,000, driven by market expansion and strong financial performance.

4. What are the key factors influencing Dixon Technologies’ share price?

Key factors include company performance, industry trends, market sentiment, and economic conditions.

5. What is the projected Dixon Technologies share price for 2050?

By 2050, Dixon Technologies could potentially reach ₹1,00,000 to ₹1,50,000, assuming continued innovation and leadership in the electronics manufacturing sector.

You May Like: Castrol India Share Price Target 2024, 2025, 2030, 2040, 2050

Conclusion

While predicting the exact Dixon Technologies share price target for the future is speculative, the company’s strong position in the electronics manufacturing sector, combined with its growth prospects in both domestic and international markets, makes it a promising investment. By continuing to innovate, expand its product portfolio, and maintain its leadership in the industry, Dixon Technologies could see substantial growth over the next few decades, potentially reaching significant stock price milestones in the long term.