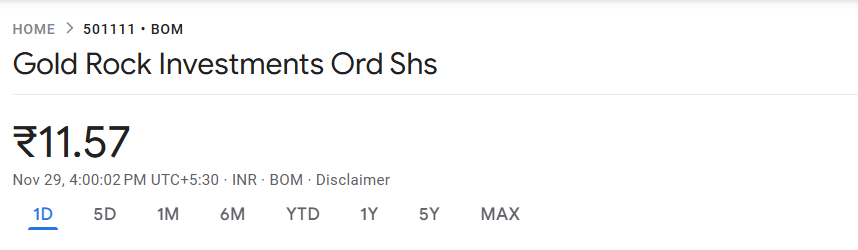

The Gold Rock Investments Ltd. share price target is an important topic for investors, particularly due to the company’s growing presence in the investment and financial services sector. As of November 27, 2024, Gold Rock Investments Ltd.’s current share price stands at ₹11.57, offering a potential entry point for investors who are considering the company’s long-term growth prospects.

While predicting exact stock prices, especially for long-term horizons like 2030, 2040, and 2050, is speculative, we can make reasonable projections based on current market trends, company performance, and broader industry developments. Here’s an overview of what the future could hold for Gold Rock Investments Ltd.’s share price and the factors that may drive its value over the coming years.

You May Like: Mayukh Dealtrade Ltd Share Price Target 2024 to 2050

Current Share Price of Gold Rock Investments Ltd.

As of November 27, 2024, Gold Rock Investments Ltd.’s current share price is ₹11.57. The company, a key player in the investment and financial services sector, has been expanding its portfolio and increasing its market presence. Analysts believe that its strategic positioning in the financial market, combined with strong management and industry growth, will support the company’s upward trajectory in the coming years.

🔴 Live

| Year | Share Price (₹) | Key Drivers |

|---|---|---|

| 2024 | ₹11.57 | Current market conditions, operational efficiency |

Gold Rock Investments Ltd. Share Price Target 2024

For 2024, the Gold Rock Investments Ltd. share price target could range between ₹13 and ₹15. This estimate is based on the company’s current performance and focus on expanding its market presence. With its steady growth and robust operational strategies, Gold Rock Investments Ltd. is expected to continue benefiting from a favorable financial environment, positive investor sentiment, and strong fundamentals.

The company’s ongoing efforts in diversifying its portfolio and expanding into new markets, alongside the overall growth in the financial services industry, will likely drive the stock price higher. If the company continues to perform well, investors can expect potential growth within this price range for the year 2024.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2024 | ₹13 – ₹15 | Company growth, market trends, investor sentiment |

Gold Rock Investments Ltd. Share Price Target 2025

Looking ahead to 2025, Gold Rock Investments Ltd.’s share price target could rise to ₹15 to ₹18. With continued expansion in its core financial services and investment sectors, Gold Rock Investments Ltd. is likely to see strong revenue growth. Analysts predict that the company’s focus on increasing market share and introducing innovative financial products will likely result in a positive impact on its stock performance.

Additionally, the favorable economic conditions and the company’s continued market development will be key factors in driving the stock price upwards. The company’s ability to maintain operational efficiency and adapt to changes in the financial landscape is expected to support its stock growth in 2025.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹15 – ₹18 | Market expansion, innovative services, positive financial trends |

Gold Rock Investments Ltd. Share Price Target 2030

By 2030, Gold Rock Investments Ltd.’s share price could potentially reach ₹30 to ₹35, assuming the company continues to innovate, expand, and maintain a competitive edge in the investment and financial services market. The company’s commitment to diversifying its investment products and services, along with its ability to adapt to the evolving market dynamics, could lead to sustained growth.

The continued rise in demand for investment services and the company’s strategic positioning in the financial sector will likely support its future stock price performance. As Gold Rock Investments Ltd. strengthens its brand presence and increases its market share, its stock price is expected to see a steady upward trend.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | ₹30 – ₹35 | Industry expansion, diversified services, brand strength |

Gold Rock Investments Ltd. Share Price Target 2040

Looking towards 2040, Gold Rock Investments Ltd.’s share price could potentially range from ₹50 to ₹60, assuming the company continues to maintain a dominant position in the investment and financial services industry. By 2040, Gold Rock Investments Ltd. could become a key player in the global financial markets, benefiting from significant market share, advanced investment technologies, and a growing demand for financial services.

The company’s focus on strategic partnerships, innovative financial products, and adapting to global market changes could support its long-term growth trajectory. Increased globalization and the demand for diversified investment solutions could further drive Gold Rock Investments Ltd.’s share price in the coming decades.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | ₹50 – ₹60 | Market leadership, global expansion, financial innovation |

Gold Rock Investments Ltd. Share Price Target 2050

Looking ahead to 2050, Gold Rock Investments Ltd.’s share price could potentially reach ₹80 to ₹100, assuming the company remains a leader in the investment and financial services industry. By 2050, Gold Rock Investments Ltd. may have significantly expanded its services, incorporating emerging financial technologies and broadening its global reach.

The company’s continued focus on expanding its portfolio of financial products, adapting to changing market conditions, and positioning itself as a leading player in the industry will likely drive substantial growth. As demand for innovative investment services grows, Gold Rock Investments Ltd. is well-positioned for long-term success.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | ₹80 – ₹100 | Global expansion, emerging financial technologies, industry leadership |

Key Factors Influencing Gold Rock Investments Ltd. Share Price

Several key factors will influence the future Gold Rock Investments Ltd. share price:

- Company Performance: The company’s financial performance, revenue growth, and profitability will significantly impact its share price. Strong financial results and operational efficiency are crucial to its long-term success.

- Industry Trends: Trends in the investment and financial services industry can influence the company’s valuation. The growing demand for diverse investment products will likely play a key role in its future growth.

- Market Sentiment: Overall market sentiment and investor confidence can affect the stock price. Positive sentiment around the financial services industry and the company’s performance could drive its valuation.

- Economic Conditions: Economic factors like interest rates, inflation, and GDP growth can impact the stock market. Strong economic conditions are likely to boost investor confidence and increase demand for financial services.

FAQs About Gold Rock Investments Ltd. Share Price

What is the current share price of Gold Rock Investments Ltd.?

As of November 27, 2024, the current share price of Gold Rock Investments Ltd. is ₹11.57.

What is the Gold Rock Investments Ltd. share price target for 2024?

The Gold Rock Investments Ltd. share price target for 2024 is expected to be between ₹13 and ₹15.

What is the Gold Rock Investments Ltd. share price target for 2030?

By 2030, Gold Rock Investments Ltd. could potentially reach a share price of ₹30 to ₹35, driven by industry expansion and diversification.

What factors will influence Gold Rock Investments Ltd.’s share price in the future?

Key factors include the company’s performance, industry trends, investor sentiment, and economic conditions.

You May Like: Hindustan Construction Company (HCC) Share Price Target 2024 to 2050

Conclusion

While predicting the exact Gold Rock Investments Ltd. share price target for the future is speculative, the company’s growth potential in the investment and financial services sector presents significant opportunities. By continuing to expand its market share, maintain strong financials, and adapt to changing market dynamics, Gold Rock Investments Ltd. is well-positioned for long-term growth. As demand for investment services increases and the company innovates with emerging financial technologies, investors can expect potential stock price appreciation over the next few decades.