The HFCL share price target has become a significant point of discussion among investors who are keen on the growth of the Indian telecommunications sector. With HFCL Ltd. focusing on key technologies like 5G infrastructure and telecom solutions, the company is well-positioned to capture substantial market opportunities in the coming decades. This article provides an in-depth look at the HFCL share price target for 2024, 2025, 2030, 2040, and 2050, based on current market trends, analyst estimates, and key company factors.

You May Like: Yes Bank Share Price Target 2025

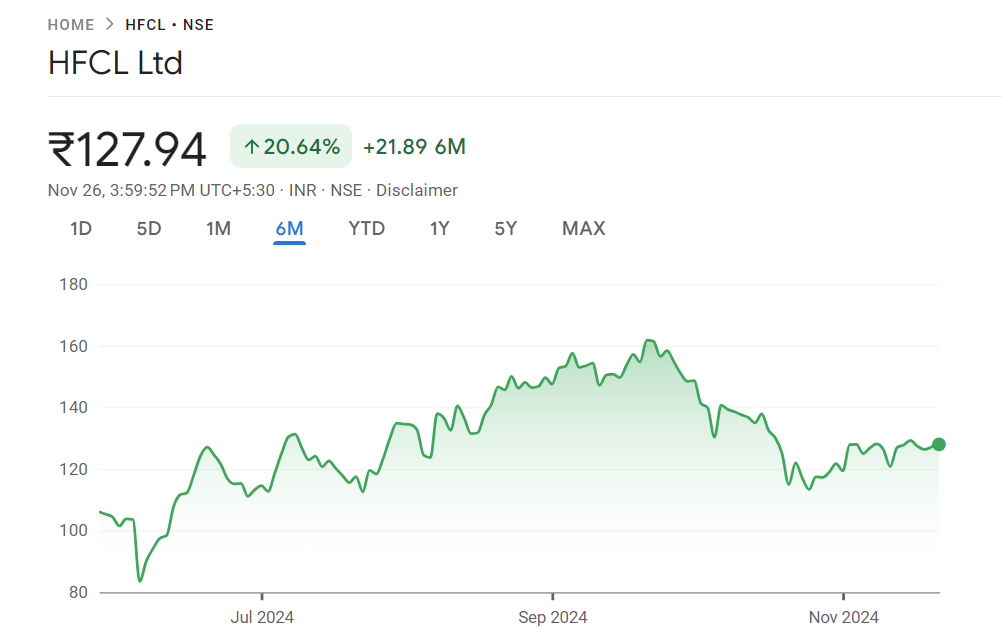

Current Share Price

As of November 26, 2024, the current share price of HFCL is ₹127.45. This reflects the company’s current standing in the market, buoyed by its continued involvement in the growth of 5G technology and other telecom advancements.

HFCL Share Price Target 2024

The HFCL share price target for 2024 is expected to range between ₹160 and ₹180, driven by the company’s strategic focus on expanding its 5G infrastructure and its ongoing projects in telecom solutions.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2024 | ₹160 – ₹180 | Strong focus on 5G infrastructure, growth in telecom services, and increasing demand for advanced solutions |

With ongoing investments in 5G technology and expanding partnerships in the telecom sector, HFCL is positioned to see steady growth in the near future.

HFCL Share Price Target 2025

By 2025, the HFCL share price target is estimated to range between ₹180 and ₹200, as the company gains momentum with its 5G projects and strengthens its position as a key player in India’s telecom sector.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹180 – ₹200 | Increased 5G network adoption, expanding market share in the telecom sector, and rising demand for high-speed internet |

The anticipated growth in the 5G sector, combined with strong financial performance, will contribute to a positive outlook for HFCL.

HFCL Share Price Target 2030

Looking further ahead to 2030, the HFCL share price target could reach between ₹300 and ₹400, given the company’s leadership role in 5G technology and the increasing adoption of advanced telecom solutions.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | ₹300 – ₹400 | Leading role in 5G rollout, continuous innovation, and a growing telecom market share in India and globally |

HFCL’s strong focus on 5G infrastructure and expanding its portfolio to include a range of telecom services should position it for significant growth.

HFCL Share Price Target 2040

By 2040, the HFCL share price target could see substantial growth, reaching between ₹700 and ₹900. This projection assumes that the company maintains its leadership in 5G technology and adapts to new technological advancements.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | ₹700 – ₹900 | Continued dominance in 5G technology, expansion into new telecom markets, and adoption of next-gen technologies |

As the global demand for telecom infrastructure continues to rise, HFCL’s consistent performance and innovation will drive long-term growth.

HFCL Share Price Target 2050

Looking ahead to 2050, the HFCL share price target could range between ₹1,500 and ₹2,000, assuming the company becomes a global leader in telecom solutions and technology.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | ₹1,500 – ₹2,000 | Global expansion, dominance in telecom infrastructure, and leadership in emerging technologies |

This ambitious target is speculative but reflects the company’s potential to maintain growth and adapt to future telecom innovations.

Key Factors Influencing HFCL’s Share Price

The HFCL share price is influenced by several critical factors:

- 5G Technology: HFCL’s focus on providing 5G infrastructure and solutions is one of the most significant growth drivers.

- Financial Performance: Consistent profitability, strong revenue growth, and efficient operations are essential for long-term growth.

- Industry Trends: Trends in the telecom industry, including the adoption of 5G, the rise in demand for high-speed internet, and changing government policies, will impact HFCL’s performance.

- Economic Conditions: Broader economic factors such as GDP growth, inflation, and interest rates can influence both demand for telecom services and investor sentiment.

- Competitive Landscape: Competition from other telecom infrastructure providers and technology companies can impact HFCL’s market share and profitability.

FAQs About HFCL Share Price Target

- What is the current share price of HFCL?

As of November 26, 2024, the current share price of HFCL is ₹127.45. - What is the HFCL share price target for 2024?

The share price target for 2024 is expected to range between ₹160 and ₹180. - What is the share price target for 2030?

The share price target for 2030 is estimated to range between ₹300 and ₹400. - What factors influence HFCL’s share price?

Key factors include its focus on 5G technology, financial performance, and industry trends. - Is HFCL a good long-term investment?

Yes, its focus on cutting-edge telecom technology, especially 5G, and its strategic market position make it a good long-term investment. - What is the projected share price for 2050?

The share price target for 2050 is estimated to range between ₹1,500 and ₹2,000.

You May Like: Orient Green Power Share Price Target 2025

Conclusion

The HFCL share price target for 2024, 2025, 2030, 2040, and 2050 highlights the company’s potential for sustained growth, especially driven by its leadership role in 5G technology and expanding telecom solutions. As HFCL Ltd. continues to innovate, adapt to market needs, and expand its global presence, it is well-positioned to capitalize on the growing demand for telecom infrastructure. For investors seeking opportunities in the evolving telecom sector, monitoring the HFCL share price offers valuable insights into future growth and long-term potential.