The Multibase India share price target for 2024 has garnered significant interest among investors, given the company’s notable performance in the specialty chemicals sector. As a subsidiary of the global chemical giant Dow Corning, Multibase India specializes in thermoplastic elastomers and silicone-based products, serving diverse industries such as automotive, construction, and consumer goods.

🔴 Live

This article provides an in-depth analysis of the Multibase India share price target for 2024, examining the company’s financial health, market position, and growth prospects.

You May Like: Empower India Share Price Target 2025, 2030, 2040, 2050

Company Overview

Multibase India Limited is a leading manufacturer and supplier of thermoplastic elastomers and silicone-based products in India. The company’s product portfolio includes polypropylene compounds, silicone masterbatches, and thermoplastic masterbatches, catering to various industrial applications. As a subsidiary of Dow Corning, Multibase India leverages global expertise to deliver innovative solutions to its clients.

Key Highlights:

- Founded: 1991

- Headquarters: Mumbai, India

- Industry: Specialty Chemicals

- Parent Company: Dow Corning

Financial Performance

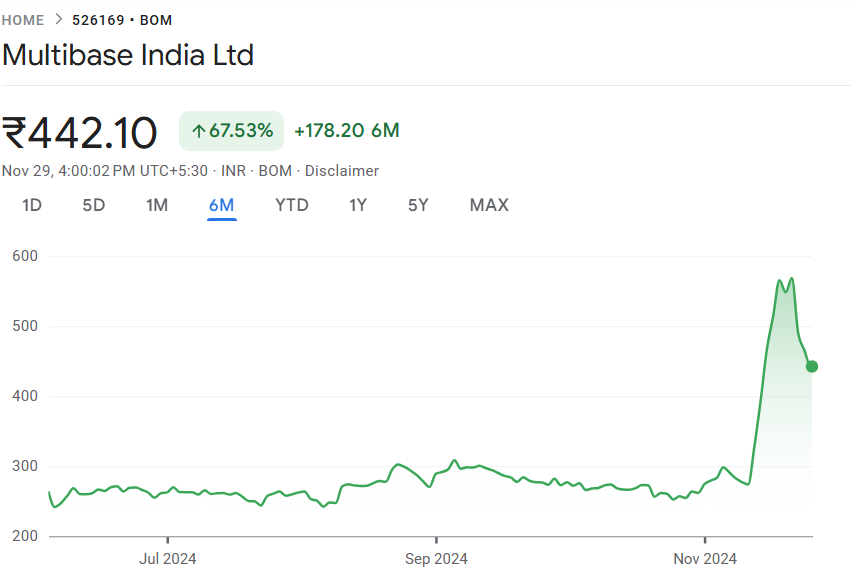

As of November 22, 2024, Multibase India’s share price stood at ₹565.30, reflecting a significant appreciation over the past year. The company’s market capitalization is approximately ₹713 crore, positioning it as a small-cap entity within the specialty chemicals sector.

Key Financial Metrics:

- Price-to-Earnings (P/E) Ratio: 47.83

- Price-to-Book (P/B) Ratio: 5.13

- 52-Week High: ₹565.30

- 52-Week Low: ₹216.50

These metrics indicate that Multibase India’s stock is trading at a premium compared to its peers, suggesting strong investor confidence in the company’s growth prospects.

Market Position and Growth Drivers

Multibase India’s robust market position is underpinned by its diversified product portfolio and strong customer relationships across various industries. The company’s focus on innovation and quality has enabled it to maintain a competitive edge in the specialty chemicals market.

Growth Drivers:

- Automotive Industry Demand: The increasing use of lightweight and durable materials in automotive manufacturing boosts demand for thermoplastic elastomers.

- Construction Sector Expansion: Growth in infrastructure projects drives the need for high-performance materials, benefiting Multibase India’s product offerings.

- Consumer Goods Market: The rising demand for high-quality consumer products supports the company’s silicone-based solutions.

Multibase India Share Price Target 2024

Based on current market trends and the company’s financial performance, the Multibase India share price target for 2024 is projected to range between ₹600 and ₹650. This projection considers the company’s strategic initiatives, market expansion, and anticipated growth in key sectors.

Year: 2024 Price Target (₹): ₹600 – ₹650 Key Drivers: Continued demand from automotive and construction industries, product innovation, and expansion into new markets.

Multibase India Share Price Target 2025

Looking ahead to 2025, the Multibase India share price target is expected to range between ₹700 and ₹750. The company’s focus on expanding its product portfolio and leveraging its parent company’s global network will drive long-term growth.

Year: 2025 Price Target (₹): ₹700 – ₹750 Key Drivers: Portfolio expansion, technological advancements, and increased demand from automotive and construction sectors.

Multibase India Share Price Target 2030

By 2030, the Multibase India share price target is projected to range between ₹1,000 and ₹1,200. This growth is attributed to the company’s innovation in sustainable materials and its ability to meet the evolving needs of industries focusing on green and energy-efficient solutions.

Year: 2030 Price Target (₹): ₹1,000 – ₹1,200 Key Drivers: Innovation in sustainable materials, energy-efficient solutions, and global market expansion.

Multibase India Share Price Target 2040

The Multibase India share price target for 2040 is expected to range between ₹1,500 and ₹1,800, reflecting the company’s leadership in the specialty materials industry. Its strategic focus on R&D and sustainability initiatives will ensure continued growth.

Year: 2040 Price Target (₹): ₹1,500 – ₹1,800 Key Drivers: Leadership in specialty materials, strong R&D focus, and sustainability initiatives.

Multibase India Share Price Target 2050

By 2050, the Multibase India share price target is anticipated to range between ₹2,000 and ₹2,500, driven by its dominance in global markets and its commitment to innovation and sustainability.

Year: 2050 Price Target (₹): ₹2,000 – ₹2,500 Key Drivers: Global market dominance, cutting-edge innovations, and sustainable material solutions.

Factors Influencing Multibase India Share Price

The Multibase India share price is influenced by several critical factors:

- Industry Growth: Rising demand for specialty materials in automotive, construction, and electronics sectors.

- Technological Advancements: Innovation in polymer compounds to meet industry-specific requirements.

- Sustainability Initiatives: Increasing focus on green and energy-efficient materials.

- Global Network: Leveraging the expertise and reach of its parent company, Dow Corning.

- Economic Recovery: Growth in manufacturing and industrial activities boosting demand for high-performance materials.

You May Like: Orient Green Power Share Price Target 2024, 2025, 2030, 2040, 2050

FAQs About Multibase India Share Price Target 2024

- What is the share price target for 2025?

- By 2025, the Multibase India share price target is expected to range between ₹700 and ₹750, driven by portfolio expansion and advancements in polymer technologies.

- What drives Multibase India’s long-term growth?

- The company’s focus on sustainable innovations, leveraging Dow Corning’s global expertise, and addressing the growing demand for high-performance materials in automotive, construction, and consumer goods sectors.

- What is the projected share price for 2030?

- By 2030, the Multibase India share price target is projected to range between ₹1,000 and ₹1,200, supported by its dominance in sustainable materials and energy-efficient solutions.

- Is Multibase India a good long-term investment?

- Yes, Multibase India Ltd. is considered a strong long-term investment due to its solid market position, consistent innovation, and alignment with global sustainability trends.

- What factors could impact the Multibase India share price?

- Factors include market volatility, global raw material prices, competition from international players, and economic conditions in key sectors like automotive and construction.

- What is the share price target for 2040?

- By 2040, the Multibase India share price target is anticipated to range between ₹1,500 and ₹1,800, reflecting its leadership in specialty chemicals and continued focus on research and development.

- How does Multibase India stay competitive in the global market?

- The company maintains its competitive edge through cutting-edge innovations, a focus on green technologies, and its integration within the global supply chain of Dow Corning.

- What is the projected share price for 2050?

- By 2050, the Multibase India share price target is estimated to range between ₹2,000 and ₹2,500, bolstered by its dominance in global markets and its commitment to sustainability and innovation.

Conclusion

The projected Multibase India share price targets for 2024, 2025, 2030, 2040, and 2050 highlight the company’s growth potential in the specialty chemicals industry. With its strong focus on sustainable innovations, global market integration, and meeting the increasing demand for high-performance materials, Multibase India Ltd. is poised to deliver significant long-term value to its investors. For those seeking a solid investment in a forward-looking industry, Multibase India offers a compelling opportunity.