The Nelco share price target is a subject of growing interest for investors, especially as the company positions itself to benefit from the expansion of the telecommunications and technology sectors. As of November 27, 2024, the current price of Nelco stands at ₹1,219.90, offering potential for future growth in the long term.

Predicting exact stock prices, particularly for long-term horizons such as 2030, 2040, and 2050, involves certain uncertainties. However, based on current market trends, company performance, and broader industry developments, we can outline some reasonable projections for Nelco’s share price in the coming years. This article will explore the factors that may influence these projections and provide a target for Nelco’s stock for the short and long term.

You May Like: Sensex Share Price Target 2024, 2025, 2030, 2040, 2050

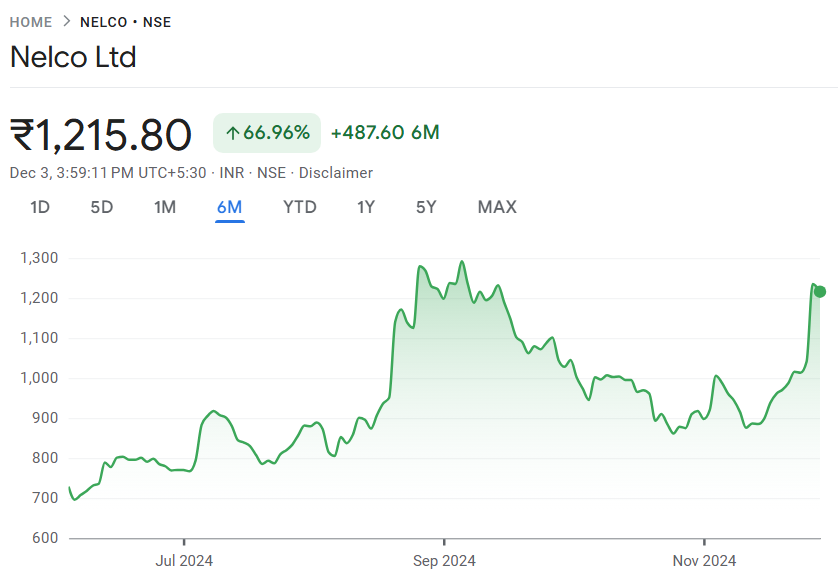

Current Nelco Share Price

As of November 27, 2024, Nelco Ltd.’s current share price is ₹1,219.90. The company has a strong presence in the telecommunications and satellite communication sectors, with continued growth driven by its innovations and partnerships in advanced technologies.

With India’s rapid adoption of modern communication technologies, Nelco stands to benefit significantly from the increasing demand for satellite services, network solutions, and broadband infrastructure. As the company focuses on strengthening its position in these high-growth areas, it holds the potential for significant appreciation in its stock value.

🔴 Live

Nelco Share Price Target 2025

Looking ahead to 2025, analysts project that Nelco’s share price could rise to between ₹1,500 and ₹1,800. Several factors are expected to drive this increase, including:

- Technological Advancements: Nelco’s investments in satellite communication and broadband services are expected to yield higher returns, driving the share price upward.

- Industry Growth: The expanding telecommunications market in India, fueled by government initiatives like Digital India, will provide a favorable environment for Nelco’s growth.

- Strong Financials: With steady revenue growth and profitability, Nelco is expected to strengthen its financial performance, boosting investor confidence.

In this period, Nelco is likely to benefit from rising demand for advanced telecom services, and its consistent performance will likely push the share price higher.

| Year | Nelco Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹1,500 – ₹1,800 | Technological advancements, Industry growth, Strong financial performance |

Nelco Share Price Target 2030

By 2030, Nelco’s share price could potentially rise to ₹2,500 to ₹3,000, as the company strengthens its position in the telecommunications and satellite communication markets. The growth in the telecom sector and technological advancements in satellite communication will be crucial drivers of Nelco’s stock price.

- Growth in Satellite Communications: As India’s demand for satellite-based services increases, Nelco is poised to gain significant market share.

- Global Market Expansion: Nelco’s efforts to expand internationally, particularly in the growing markets of Africa and Southeast Asia, could add significant value to the company’s stock price.

- Diversification of Offerings: Nelco’s strategic focus on broadening its product offerings, including broadband, 5G services, and satellite solutions, will contribute to its long-term growth.

With these growth prospects, Nelco is expected to see substantial appreciation in its stock price by 2030.

| Year | Nelco Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | ₹2,500 – ₹3,000 | Satellite communication growth, Global expansion, Diversification |

Nelco Share Price Target 2040

Looking to 2040, Nelco’s share price could potentially reach ₹4,000 to ₹5,000. This forecast is based on several optimistic factors that could contribute to a significant increase in the company’s valuation:

- Technological Leadership: Nelco’s continued innovation in satellite technology, 5G, and other next-gen communication systems will position the company for sustainable growth in the decades to come.

- Global Market Dominance: As Nelco expands its operations globally, particularly in underserved regions, it could capture a large share of the international market, which would drive its share price higher.

- Strategic Partnerships: The company’s ability to form key alliances with global telecom players, governments, and industries will further enhance its market position and stock value.

With these factors in mind, Nelco could see its share price significantly appreciate as the company matures and continues to lead in the telecommunications and satellite sectors.

| Year | Nelco Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | ₹4,000 – ₹5,000 | Technological leadership, Global market expansion, Strategic partnerships |

Nelco Share Price Target 2050

By 2050, Nelco’s share price could potentially soar to ₹7,000 to ₹10,000, assuming the company remains at the forefront of emerging technologies and capitalizes on the global transition to high-speed internet, 5G, and satellite communications. Although predicting exact values for such a long-term horizon is speculative, here are a few factors that could influence Nelco’s stock price:

- Industry Leadership: As a leader in satellite communications, Nelco could dominate both the domestic and global markets, particularly as new technologies like 6G and satellite-based internet become widespread.

- Sustainability and Innovation: Continued investments in green technologies and environmentally-friendly satellite solutions will drive Nelco’s growth in a world increasingly focused on sustainability.

- Market Leadership: Nelco’s established global presence in telecommunications and satellite networks, along with partnerships and acquisitions, will solidify its position, leading to significant stock price appreciation.

If Nelco continues its path of technological innovation and global expansion, the company could see substantial gains in market value, positioning it for long-term success.

| Year | Nelco Share Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | ₹7,000 – ₹10,000 | Industry leadership, Technological innovation, Market dominance |

Key Factors Influencing Nelco’s Share Price

Several key factors will influence the future Nelco share price:

- Company Performance: Nelco’s financial performance, including profitability, revenue growth, and cost management, will have a significant impact on its share price. Positive financial results will boost investor confidence.

- Industry Trends: Trends in the telecommunications industry, such as the roll-out of 5G, growing demand for satellite communication, and government initiatives to enhance digital connectivity, will influence Nelco’s performance.

- Economic Conditions: Economic factors, including interest rates, inflation, and overall GDP growth, play a crucial role in shaping the performance of stocks in the telecommunications sector, including Nelco.

- Market Sentiment: Investor confidence and market sentiment, especially in the tech and telecom sectors, can significantly affect the stock price of Nelco. Bullish sentiment can drive the stock higher, while bearish trends can lead to declines.

- Technological Advancements: As Nelco invests in and develops next-generation technologies, its ability to innovate and lead in satellite communications and telecom infrastructure will determine its future growth and stock performance.

FAQs About Nelco Share Price

1. What is the current share price of Nelco?

As of November 27, 2024, the current share price of Nelco is ₹1,219.90.

2. What is Nelco’s share price target for 2025?

For 2025, analysts predict that the Nelco share price target could range between ₹1,500 and ₹1,800.

3. What is Nelco’s share price target for 2030?

By 2030, Nelco’s share price could potentially reach ₹2,500 to ₹3,000, driven by growth in satellite communications and global expansion.

4. What factors influence Nelco’s share price?

Key factors include the company’s performance, technological innovations, industry trends, economic conditions, and investor sentiment.

5. What is the expected Nelco share price for 2050?

By 2050, Nelco’s share price could range from ₹7,000 to ₹10,000, assuming continued industry leadership and technological advancements.

You May Like: Gold Rock Investments Ltd Share Price Target 2024 to 2050

Conclusion

While predicting the exact Nelco share price target for the future remains speculative, the company’s growth potential in the telecommunications and satellite communication industries presents significant opportunities. By continuing to innovate, expand its market reach, and capitalize on emerging technologies, Nelco could see substantial gains in its stock value over the next few decades. Investors can look forward to a positive outlook as the company evolves into a key player in the global telecom and satellite communications sectors.