The NTPC Green Energy IPO share price has garnered significant attention from investors as the company positions itself as a major player in India’s renewable energy sector. With the growing global shift towards sustainability, NTPC Green Energy has become a prominent name in the renewable energy market, particularly focusing on wind and solar power generation.

As of now, NTPC Green Energy remains a subsidiary of NTPC Ltd, but the company’s move toward its own IPO and public listing is highly anticipated. This article explores the potential share price targets for NTPC Green Energy for the years 2024, 2025, 2030, 2040, and 2050, based on current industry trends, company performance, and forecasts.

You May Like: Share Price of Swiggy Ltd 2024, 2025, 2030, 2040, 2050

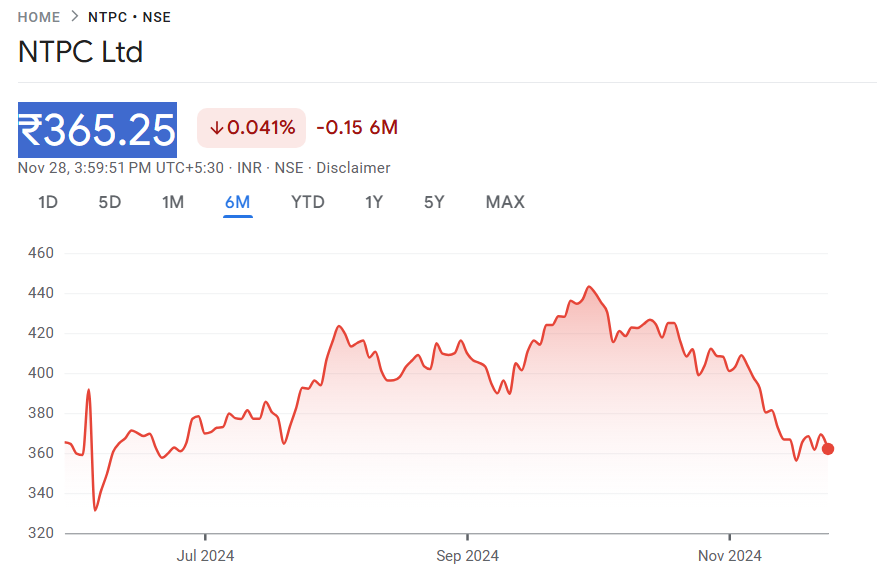

Current Share Price of NTPC Green Energy

As of November 27, 2024, NTPC Green Energy’s current price is estimated at ₹365.25. This price is based on the company’s private market valuation as it continues to operate under the umbrella of NTPC Ltd.

The NTPC Green Energy IPO is highly anticipated by investors, particularly given the growing demand for clean energy solutions in India and globally. However, since NTPC Green Energy is still a part of a publicly traded parent company, it does not have a standalone share price available on the stock exchanges at the moment.

Predicting NTPC Green Energy’s IPO share price in the coming years depends largely on its market performance, government policies on renewable energy, and the company’s ability to scale its operations effectively.

| Year | Share Price (₹) | Key Drivers |

|---|---|---|

| 2024 | ₹365.25 | Current private valuation, energy sector growth |

NTPC Green Energy IPO Share Price Target 2024

For 2024, it is important to note that NTPC Green Energy does not have a publicly traded share price as of now. However, based on the growing interest in renewable energy, the NTPC Green Energy IPO could be priced attractively if it goes public. Experts predict that the IPO price could be in the range of ₹350 to ₹400 per share, depending on market conditions and investor demand.

In 2024, the company’s share price target will depend largely on its ability to attract investor interest based on its renewable energy projects, financial performance, and future growth potential.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2024 | ₹350 – ₹400 | IPO pricing, renewable energy demand, market sentiment |

NTPC Green Energy IPO Share Price Target 2025

Looking forward to 2025, NTPC Green Energy’s share price is expected to rise gradually as the company continues to focus on expanding its renewable energy capacity. Analysts predict a share price target for 2025 to range between ₹450 to ₹500. This increase in price is driven by the company’s growth trajectory, particularly in the areas of solar and wind energy generation.

As India accelerates its transition to renewable energy, NTPC Green Energy’s involvement in large-scale renewable projects could lead to a strong market presence, boosting investor confidence. Moreover, government policies in favor of clean energy could further propel the company’s growth, leading to an upward revision of its share price target.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹450 – ₹500 | Market growth, government policies, clean energy projects |

NTPC Green Energy IPO Share Price Target 2030

By 2030, NTPC Green Energy could have solidified itself as one of the leading renewable energy companies in India. While predicting NTPC Green Energy’s share price for 2030 is speculative, analysts suggest that the company’s price could reach between ₹800 to ₹1,000 per share, depending on various factors.

The key drivers for NTPC Green Energy’s share price by 2030 will include the continued growth of India’s renewable energy market, increasing demand for solar and wind energy, and the company’s ability to scale its operations both domestically and internationally. Further, technological advancements and government incentives could also play a role in boosting the company’s performance and valuation.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | ₹800 – ₹1,000 | Expansion in renewable energy capacity, technological advancements, government support |

NTPC Green Energy IPO Share Price Target 2040

By 2040, NTPC Green Energy could become a global leader in the renewable energy sector, depending on its ability to innovate and expand into new international markets. As the global demand for clean energy solutions continues to grow, NTPC Green Energy’s share price could appreciate significantly, potentially reaching ₹1,500 to ₹2,000 per share.

However, these projections are highly speculative. Much will depend on the company’s ability to capitalize on renewable energy trends, including wind, solar, and possibly even newer technologies like green hydrogen. The global push for decarbonization and the potential for large-scale international projects will likely drive NTPC Green Energy’s growth, contributing to an upward trajectory in its share price target.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | ₹1,500 – ₹2,000 | International expansion, technological leadership, global renewable energy trends |

NTPC Green Energy IPO Share Price Target 2050

Looking even further ahead to 2050, NTPC Green Energy could evolve into one of the world’s foremost leaders in renewable energy. By then, the company could have a global footprint and be involved in a wide range of renewable energy projects across various continents.

Projections for NTPC Green Energy’s share price in 2050 are highly speculative, but estimates suggest it could reach as high as ₹3,000 to ₹5,000 per share, depending on the company’s continued ability to innovate and execute its business strategy. By this time, the company’s market capitalization could be driven by the increasing global reliance on clean energy and NTPC Green Energy’s position as a key player in this space.

The long-term share price will be influenced by factors such as global energy policies, technological innovations, and competition within the renewable energy industry.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | ₹3,000 – ₹5,000 | Global market leadership, sustainability, energy transition trends |

Factors Influencing NTPC Green Energy’s Share Price

If NTPC Green Energy were to go public, several factors would significantly influence its share price:

- Renewable Energy Focus: The company’s commitment to expanding its renewable energy portfolio, particularly in solar and wind energy, will be a key driver of future growth. As demand for clean energy solutions rises, NTPC Green Energy could see substantial revenue growth.

- Financial Performance: Consistent profitability, efficient operations, and strong revenue growth will be important factors that determine NTPC Green Energy’s share price after an IPO. Investors will look for clear financial stability before committing capital.

- Industry Trends: The renewable energy industry is subject to rapid changes in technology, consumer preferences, and government policies. As such, NTPC Green Energy must remain flexible and adaptive to these changes to maintain its competitive edge.

- Economic Conditions: Broader economic conditions such as GDP growth, inflation, and interest rates will also influence investor sentiment and NTPC Green Energy’s market performance. In times of economic uncertainty, renewable energy companies might face challenges in maintaining profitability.

You May Like: Mr Beast Chocolate share price 2024, 2025, 2030, 2040, 2050

FAQs About NTPC Green Energy IPO Share Price

What is the current share price of NTPC Green Energy?

As of November 27, 2024, the current share price of NTPC Green Energy is around ₹365.25 based on private market valuations.

What is NTPC Green Energy’s share price target for 2024?

While no official share price target is available for 2024, predictions suggest that if NTPC Green Energy were to go public, its IPO price might range from ₹350 to ₹400 per share.

What is NTPC Green Energy’s share price target for 2030?

By 2030, NTPC Green Energy’s share price could range from ₹800 to ₹1,000, assuming the company continues to scale its renewable energy projects and expand its market share.

Will NTPC Green Energy go public?

While no specific timeline has been set, the growing demand for clean energy solutions and the company’s potential growth may lead NTPC Green Energy to consider an IPO in the future.

What factors could influence NTPC Green Energy’s share price?

Factors such as market trends in renewable energy, financial performance, government policies, and global economic conditions will play a significant role in influencing NTPC Green Energy’s share price post-IPO.