The Orient Green Power share price target has been a topic of increasing interest among investors, especially those looking to capitalize on the growing renewable energy sector. Orient Green Power Ltd., with its focus on clean and sustainable energy, is positioned to benefit from the global shift towards renewable energy. This article provides a comprehensive analysis of the Orient Green Power share price target for 2024, 2025, 2030, 2040, and 2050, based on current market trends, company performance, and industry forecasts.

You May Like: Urja Global Share Price Target 2024, 2025, 2030, 2040, 2050

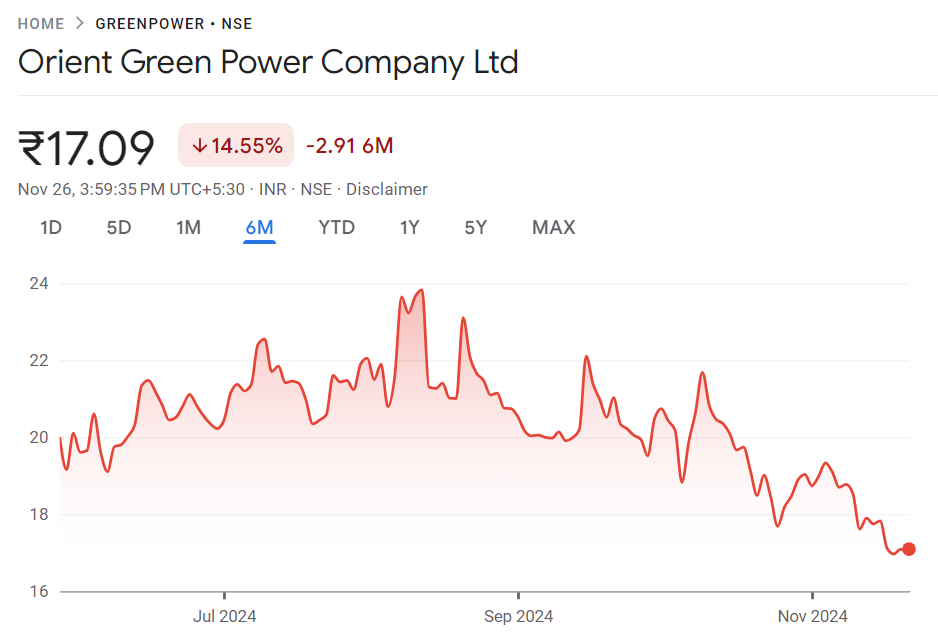

Current Share Price

As of November 26, 2024, the current share price of Orient Green Power is ₹17.35. This price reflects the company’s current market performance and its position within the renewable energy industry.

Orient Green Power Share Price Target 2024

The Orient Green Power share price target for 2024 is expected to range between ₹20 and ₹25. This short-term growth is driven by the increasing focus on renewable energy projects, both in India and globally, along with the company’s ongoing efforts to expand its energy portfolio.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2024 | ₹20 – ₹25 | Focus on renewable energy, government incentives, and strong domestic energy demand |

The Orient Green Power share price could see a positive impact from increased government support for clean energy projects and the company’s expanding renewable energy portfolio.

Orient Green Power Share Price Target 2025

By 2025, the Orient Green Power share price target is projected to range between ₹30 and ₹40. This projection is based on the company’s strengthened position in renewable energy, increasing revenue from wind and solar power, and improved operational efficiency.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹30 – ₹40 | Expansion in renewable energy, stronger financial performance, and increased investor confidence |

The company’s focus on expanding its capacity in solar and wind power generation is likely to drive further growth in the coming years.

Orient Green Power Share Price Target 2030

Looking ahead to 2030, the Orient Green Power share price target is expected to range between ₹100 and ₹150. Given the increasing global shift towards renewable energy, and the company’s efforts to maintain a strong presence in the sector, this significant long-term growth is achievable.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | ₹100 – ₹150 | Leadership in renewable energy, increased market share in solar and wind power, and technological innovations |

The company’s investments in emerging renewable technologies and its increasing focus on sustainable energy solutions could position it for substantial growth.

Orient Green Power Share Price Target 2040

By 2040, the Orient Green Power share price target could range between ₹250 and ₹300, assuming the company maintains its competitive edge in the renewable energy space. Long-term projections are highly speculative, but the share price could benefit from global expansion, increased demand for clean energy, and ongoing technological advancements.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | ₹250 – ₹300 | Global market expansion, advancements in renewable technologies, and leadership in sustainable energy |

Orient Green Power Share Price Target 2050

The Orient Green Power share price target for 2050 is speculative, but considering the potential global dominance in renewable energy, the share price could reach ₹500 to ₹600, driven by market leadership in clean energy solutions and continued technological advancements.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | ₹500 – ₹600 | Global leadership in renewable energy, technological innovations, and strategic international partnerships |

Key Factors Influencing Orient Green Power’s Share Price

Several key factors influence the Orient Green Power share price:

- Renewable Energy Focus: The company’s focus on expanding its renewable energy projects in India and globally will significantly impact its growth and valuation.

- Financial Performance: Consistent profitability, strong revenue growth, and efficient operations are essential for maintaining investor confidence and supporting future share price growth.

- Industry Trends: The overall trends in the renewable energy sector, including technological advancements, government policies, and global sustainability goals, will influence the company’s performance.

- Economic Conditions: Economic factors, such as GDP growth, interest rates, and inflation, can impact consumer demand for clean energy and investor sentiment.

- Government Policies: Continued support from governments for renewable energy projects through subsidies and incentives will play a critical role in the company’s growth trajectory.

FAQs About Orient Green Power Share Price Target

- What is the current share price of Orient Green Power?

As of November 26, 2024, the current share price of Orient Green Power is ₹17.35. - What is the Orient Green Power share price target for 2024?

The share price target for 2024 is expected to range between ₹20 and ₹25. - What is the projected share price for 2030?

The share price target for 2030 is expected to range between ₹100 and ₹150. - What factors influence Orient Green Power’s share price?

Key factors include its focus on renewable energy, financial performance, and industry trends. - Is Orient Green Power a good long-term investment?

Yes, its strong position in the renewable energy sector, consistent growth, and focus on sustainability make it a good long-term investment. - What is the share price target for 2050?

The share price target for 2050 is estimated to range between ₹500 and ₹600.

You May Like: Orient Green Power Share Price Target 2025

Conclusion

The Orient Green Power share price target for 2024, 2025, 2030, 2040, and 2050 reflects the company’s potential for growth in the renewable energy sector. With its strong focus on sustainability, expanding renewable energy capacity, and ability to adapt to market dynamics, Orient Green Power Ltd. is positioned to be a key player in the future of clean energy. For investors looking to take advantage of the growth in renewable energy, tracking the Orient Green Power share price offers valuable insights and opportunities for long-term success.