The share price of Swiggy Ltd has piqued the interest of investors and market enthusiasts, especially as the company solidifies its dominance in India’s food delivery and quick commerce markets. While Swiggy remains a private company, many are curious about its potential valuation and the factors that could drive its future share price.

However, predicting Swiggy’s share price target for the coming years is not an easy task, as the company’s future performance will depend on a variety of factors, including market conditions, competition, and consumer trends. In this article, we will explore what Swiggy’s share price targets for 2024, 2025, 2030, 2040, and 2050 could look like, based on current insights and future growth potential.

You May Like: Mr Beast Chocolate share price 2024, 2025, 2030, 2040, 2050

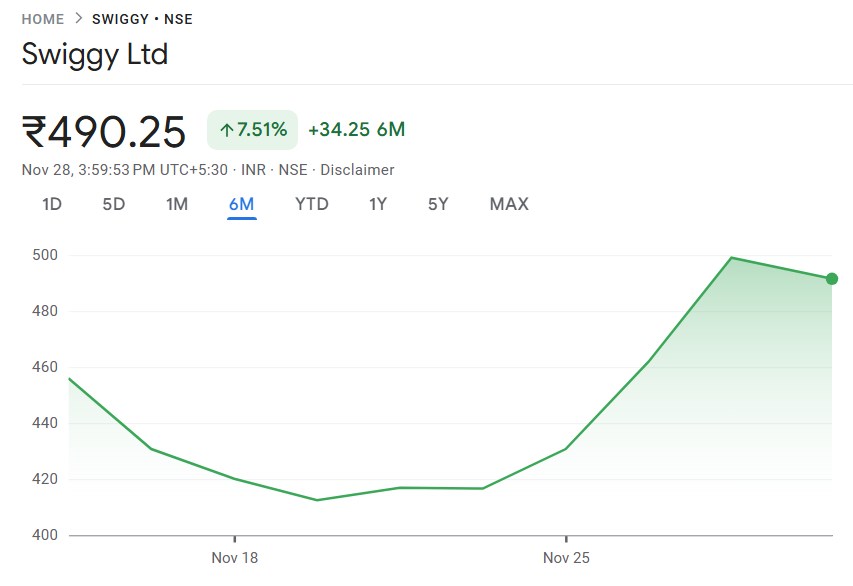

Current Share Price of Swiggy

As of November 27, 2024, Swiggy’s estimated current price based on private market valuations is around ₹491.70. This valuation is determined by recent funding rounds and investor interest in the company, but it does not reflect a publicly traded stock price. Since Swiggy is a privately held company, its share price cannot be publicly tracked through stock exchanges.

However, if Swiggy were to eventually go public, its share price would be influenced by its revenue, market share, and broader industry trends. Now, let’s take a closer look at potential share price targets for Swiggy in the years to come.

Swiggy Share Price Target 2024

For 2024, predicting a precise share price target for Swiggy is challenging due to its private status. If Swiggy were to go public in 2024, its share price would likely be impacted by several key factors, such as growth in the food delivery market, technological advancements, and the expansion of quick commerce services like Swiggy Instamart.

Analysts expect Swiggy to continue strengthening its market position, especially with its investments in technology and customer experience. The company’s strong brand recognition and leadership in the food delivery sector could push its valuation higher.

As of now, there is no official Swiggy share price target for 2024, but the company’s continued expansion and the potential for an IPO could contribute to increased investor interest.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2024 | Not Applicable | Private company status, growth in food delivery, technological advancements |

Swiggy Share Price Target 2025

Looking ahead to 2025, the share price of Swiggy could increase to ₹600 to ₹700, based on current growth trajectories. By 2025, Swiggy could expand its services beyond food delivery to include new revenue streams such as grocery delivery, cloud kitchens, and last-mile logistics.

Swiggy’s potential IPO could be a significant catalyst for its share price, as investors would likely value the company based on its revenue growth and profitability trends. As a market leader in India, Swiggy’s future share price would also depend on competition from other players like Zomato and global entrants into the quick commerce space.

Analysts predict that Swiggy’s share price target in 2025 would be closely tied to its ability to maintain its market leadership and expand internationally.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2025 | ₹600 – ₹700 | Strategic expansion, profitability improvements, IPO consideration |

Swiggy Share Price Target 2030

By 2030, Swiggy could have cemented its position as a global leader in food delivery and quick commerce. Predictions for Swiggy’s share price in 2030 are speculative, as much will depend on how the company evolves in the coming years. Factors such as global expansion, market diversification, and technological innovations will play a major role.

Swiggy’s ability to continue innovating with its services, such as autonomous delivery or AI-powered logistics, could position it as a dominant force. Additionally, Swiggy’s efforts in sustainability and building a strong brand presence will likely influence its future valuation.

However, as of now, there is no official Swiggy share price target for 2030, as the company would still need to prove its long-term sustainability and market leadership.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2030 | Not Applicable | Global expansion, innovation, sustainability practices |

Swiggy Share Price Target 2040

Looking even further ahead, Swiggy could potentially transform into a global powerhouse by 2040, leading not just the Indian market but also achieving significant global penetration. By this time, Swiggy’s share price could be influenced by its diversification into new sectors, such as logistics technology, food tech, and even health-oriented meal services.

However, predicting Swiggy’s share price for 2040 remains speculative. The company’s success would depend on the adoption of emerging technologies like autonomous vehicles and drones for delivery. Additionally, the regulatory landscape and competition from other large companies in the space could also have a significant impact.

Despite these uncertainties, if Swiggy continues to innovate and expand its market presence, its share price could reflect a strong valuation by 2040.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2040 | Not Applicable | Technological leadership, global presence, innovation |

Swiggy Share Price Target 2050

By 2050, Swiggy could be a leading global brand, not just for food delivery but also for broader consumer goods and services. The share price of Swiggy in 2050 could be influenced by its market dominance, innovation, and leadership in the sustainable food production and delivery industry.

At this point, Swiggy’s share price could be impacted by factors such as its continued diversification into areas like food tech, personalized meal delivery, and partnerships with global retailers. The company’s success in leveraging next-gen technologies such as AI-driven logistics and delivery automation will be a key determinant of its future valuation.

While predicting Swiggy’s share price for 2050 is highly speculative, its long-term market leadership and innovation could position it as a major player in the global food industry.

| Year | Price Target (₹) | Key Drivers |

|---|---|---|

| 2050 | Not Applicable | Global market leadership, sustainability, food tech innovations |

Factors Influencing Swiggy’s Share Price (If Public)

If Swiggy were to go public, several factors could influence its share price:

- Market Growth: The rapid growth of India’s online food delivery and quick commerce markets will be crucial in determining Swiggy’s success. The shift towards convenience and doorstep delivery is expected to continue in the coming years.

- Technological Innovation: Swiggy’s ability to implement new technologies, such as AI-powered delivery systems, machine learning for customer preferences, and drone-based logistics, will be key to staying ahead of the competition.

- Financial Performance: Investors will closely track Swiggy’s financial performance, including revenue growth, profitability, and operational efficiency, as these are key indicators of long-term viability.

- Competitive Landscape: The competitive environment, especially with Zomato, international players, and new entrants, will also significantly impact Swiggy’s market share and pricing strategy.

FAQs About Swiggy’s Share Price

What is the current share price of Swiggy?

As of now, Swiggy is a private company, and its share price is not publicly available. Based on private valuations, Swiggy’s estimated price is ₹491.70 as of November 2024.

What is Swiggy’s share price target for 2024?

There is no official share price target for 2024, as Swiggy remains a private company. However, analysts predict strong growth and potential for an IPO in the near future.

What is Swiggy’s share price target for 2030?

Predicting Swiggy’s share price for 2030 is speculative. It will depend on factors such as global expansion, technological innovations, and the company’s ability to sustain long-term growth.

Will Swiggy ever go public?

While there is no clear timeline, Swiggy may consider an IPO in the future if it continues to grow and stabilize its profitability.

What factors could influence Swiggy’s share price if it were public?

Key factors include market growth, technological innovation, financial performance, and competition from other food delivery services and quick commerce platforms.

You May Like: Elite Mindset Share Price Target 2024, 2025, 2030, 2040, 2050

Conclusion

The share price of Swiggy Ltd for 2024, 2025, 2030, 2040, and 2050 remains speculative, as Swiggy is currently a private company. However, with its ongoing market dominance in India and plans for future innovation, Swiggy is well-positioned for growth in the coming decades. Investors and consumers alike will need to stay updated on the company’s journey as it expands its footprint, diversifies its services, and potentially prepares for an IPO.